Working Capital Formula |

您所在的位置:网站首页 › working capital management › Working Capital Formula |

Working Capital Formula

|

Working Capital Formula

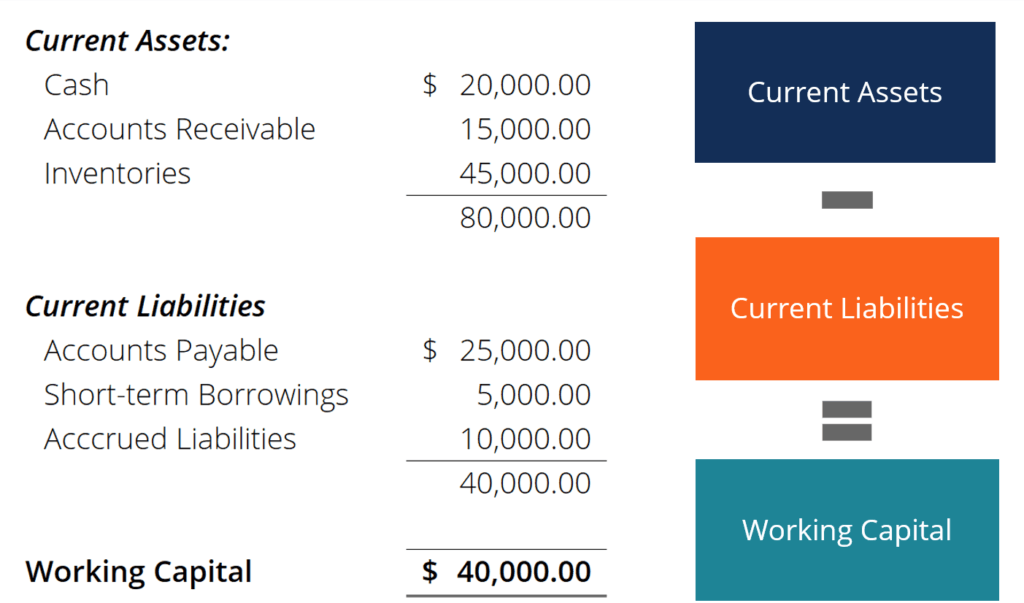

Working capital is equal to current assets minus current liabilities. Written by CFI Team Updated April 21, 2023 What is the Working Capital Formula?The working capital formula is: Working Capital = Current Assets – Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. It is a measure of a company’s short-term liquidity and is important for performing financial analysis, financial modeling, and managing cash flow. Below is an example balance sheet used to calculate working capital.

A company can increase its working capital by selling more of its products. If the price per unit of the product is $1000 and the cost per unit in inventory is $600, then the company’s working capital will increase by $400 for every unit sold, because either cash or accounts receivable will increase. Comparing the working capital of a company against its competitors in the same industry can indicate its competitive position. If Company A has working capital of $40,000, while Companies B and C have $15,000 and $10,000, respectively, then Company A can spend more money to grow its business faster than its two competitors. What is working capital?Working capital is the difference between a company’s current assets and current liabilities. It is a financial measure, which calculates whether a company has enough liquid assets to pay its bills that will be due within a year. When a company has excess current assets, that amount can then be used to spend on its day-to-day operations. Current assets, such as cash and equivalents, inventory, accounts receivable, and marketable securities, are resources a company owns that can be used up or converted into cash within a year. Current liabilities are the amount of money a company owes, such as accounts payable, short-term loans, and accrued expenses, that are due for payment within a year. Positive vs negative working capitalHaving positive working capital can be a good sign of the short-term financial health of a company because it has enough liquid assets remaining to pay off short-term bills and to internally finance the growth of its business. With a working capital deficit, a company may have to borrow additional funds from a bank or turn to investment bankers to raise more money. Negative working capital means assets aren’t being used effectively and a company may face a liquidity crisis. Even if a company has a lot invested in fixed assets, it will face financial and operating challenges if liabilities are due. This may lead to more borrowing, late payments to creditors and suppliers, and, as a result, a lower corporate credit rating for the company. When negative working capital is okDepending on the type of business, companies can have negative working capital and still do well. Examples are grocery stores like Walmart or fast-food chains like McDonald’s that can generate cash very quickly due to high inventory turnover rates and by receiving payment from customers in a matter of a few days. These companies need little working capital being kept on hand, as they can generate more in short order. Products that are bought from suppliers are immediately sold to customers before the company has to pay the vendor or supplier. In contrast, capital-intensive companies that manufacture heavy equipment and machinery usually can’t raise cash quickly, as they sell their products on a long-term payment basis. If they can’t sell fast enough, cash won’t be available immediately during tough financial times, so having adequate working capital is essential. Learn more about a company’s Working Capital Cycle, and the timing of when cash comes in and out of the business. Adjustments to the working capital formulaWhile the above formula and example are the most standard definition of working capital, there are other more focused definitions. Examples of alternative formulas: Current Assets – Cash – Current Liabilities (excludes cash) Accounts Receivable + Inventory – Accounts Payable (this represents only the “core” accounts that make up working capital in the day-to-day operations of the business) Download the free templateEnter your name and email in the form below and download the free template now! Working Capital TemplateDownload the free Excel template now to advance your finance knowledge! Working capital in financial modelingWe hope this guide to the working capital formula has been helpful. If you’d like more detail on how to calculate working capital in a financial model, please see our additional resources below. Free Fundamentals of Credit Course Financial Modeling Courses Financial Modeling Guide DCF Model Training How to Be a Great Financial Analyst See all financial modeling resources |

【本文地址】